CatIQ Issues Annual Update of Insurance Industry Exposure Database for Canada, Developed in Partnership with PERILS

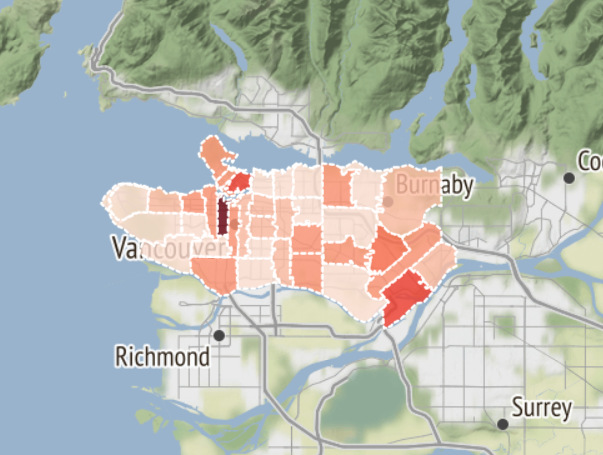

Toronto (May 9, 2019) – Catastrophe Indices & Quantification Inc. (CatIQ) today released the annual update of its Canadian insurance Industry Exposure Database (IED), developed with the support of the Canadian P&C industry and in partnership with Zurich-based PERILS AG. The IED now contains 2018 year-end estimates of Canadian industry property sums insured.

As in the 2017 and 2016 year-end datasets, the industry property sums insured are by:

- Canada Post Forward Sortation Area (FSA)

- Peril (windstorm, hail, fire, flood, sewer back-up, earthquake and volcanic eruption)

- Line of business (personal, commercial, and motor hull)

- Cover type (building, vehicle, contents, business interruption and additional living expense, where applicable)

Launched in June 2018, CatIQ’s IED is based on detailed exposure submissions from a majority of the Canadian Insurance market. Consistent with PERILS’ methodology, CatIQ’s IED is updated annually. Also, with the support of the participating insurers, CatIQ produces industry loss estimates at the FSA level as follows:

- The same perils, lines of business and cover types as listed above

- Any catastrophe that results in an industry loss greater than C$300 million

- At three months, 6 months, 1 year and, if industry loss exceeds C$500 million, 2 years after the event

This detailed loss dataset is now comprised of three major events, including the 2016 Fort McMurray Wildfire, the 2018 May Windstorm in Ontario and Quebec, and the Ottawa and Gatineau tornadoes of September 2018.

Commenting on the announcement, Joel Baker, CEO of CatIQ, said, “The update of CatIQ’s Canadian IED and Loss platform will provide immense value to insurers, reinsurers, brokers and modelers.” He added that, “the unprecedented level of detail available in the platform supports improved modelling, benchmarking and risk-transfer solutions. We are thrilled that several large insurers have joined the IED in 2018 and 2019 and that the market share of participating companies now stands over 60%.”

Eduard Held, Head of Products at PERILS, added: “The availability of both insured market exposure and market loss data, produced with the identical methodology and stemming from the same sources, ensures a high degree of consistency. Such consistency is essential when combining the two datasets, be it for the validation of nat cat risk models or for performing exposure and loss benchmarking. We are delighted that our partnership with CatIQ successfully led to such high-quality IEDs, benefiting the entire Canadian re/insurance market.”

CatIQ’s IED module is available as an add-on to CatIQ’s existing services, heralded as the most reliable source of CAT loss information in Canada. Primary insurers participating in the IED program receive the IED module at no extra charge. Furthermore, CatIQ’s Canadian IED and granular loss information is made available on the PERILS platform. In addition to Canada, PERILS’ Industry Exposure and Loss Database covers Australia, Austria, Belgium, Denmark, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Norway, Sweden, Switzerland, Turkey, and the United Kingdom.

About CatIQ

Toronto-based Catastrophe Indices and Quantification Inc. (CatIQ) delivers detailed analytical and meteorological information on Canadian natural and man-made catastrophes. Through its online subscription-based platform, CatIQ combines comprehensive insured loss and exposure indices, meteorological and GIS analytics and other related information to better serve the needs of the insurance / reinsurance / ILS industries, the public sector and other stakeholders. CatIQ was established in 2014 with the support of the overwhelming majority of the Canadian insurance/reinsurance industry and is widely recognized as the most reliable source of Cat loss information in Canada. CatIQ is affiliated with MSA Research Inc., Canada’s dominant provider of financial analytics covering the P&C and Life/Health insurance sectors.

About PERILS AG

PERILS is an independent Zurich-based organization providing industry-wide natural catastrophe exposure and event loss data. The PERILS Industry Exposure & Loss Database is available to all interested parties via annual subscription. PERILS industry loss estimates, provided via the PERILS Industry Loss Index Service, can be used as triggers in insurance risk transactions such as industry loss warranty contracts (ILW) or insurance-linked securities (ILS) and currently covers the following 16 countries: Australia, Austria, Belgium, Canada, Denmark, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Norway, Sweden, Switzerland, Turkey, and the United Kingdom. The use of PERILS exposure and loss data other than in conjunction with a valid PERILS License and according to its terms, by a Licensee or an Authorized User as defined in the License, is illegal and expressly forbidden.

More information can be found at https://www.catiq.com and https://www.perils.org

Contacts:

Laura Twidle Nigel Allen

+1 416 368 0777 x30 +44 7988 478824